Bitcoin OVER 40,000 USD...

Headlines screamed, hedge fund managers panicked, investors bought in at a frantic rate!

Who would have thought?

The meteoric rise we saw over the last year has been a sight to behold!

One which few expected or planned for - which culminated in the FOMO (fear of missing out) rush that saw the cryptocurrency pushing the price above $48,000 in early February 2021.

In just one year, we have seen some mind-numbing gains...

Amazing!

And simply put, this is a market that can no longer be ignored.

So let's take a deeper dive into why this happened, and what we can expect from 2021. This will be the first of a series of reviews of global markets in 2020 - with some sneak peeks into the future.

If we take a step back, in some ways it is not surprising at all that we have seen the rise of digital assets in a year when the world turned digital amidst the ‘pandemic’.

But there is more to this than just a fundamental shift.

Because, contrary to conventional belief, fundamentals themselves are not the main driver of financial markets.

Mass human sentiment is.

And, boy oh boy, have we seen human emotions in FULL force this year!

From the crash of March 2020 when we tumbled from over 10,000 to sub-4000 was a real test of any Bitcoin investors ability to keep their emotions out of the game...

...only for the tables to turn again, as stocks, cryptos and more rallied from the crippling March sell-off.

And it wasn’t just crypto currencies that had such a roller-coaster.

In the year of 2020, asset prices collapsed dramatically, only to rise to new highs on the back of central banks issuing out credit (stimulus) like never ever before, effectively printing money (debt) which, of course, has to be repaid at some stage!

When the world is in a state of such flux and change, we often see persons reverting back to some stability -

Think Gold, think USD.

But then...enter Bitcoin.

Bitcoin has been around for over 10 years, but is still the new kid on the block in comparison to these other two examples.

But that is certainly changing, as education is slowly starting to spread as to its value as a non-regulated medium of exchange, private portable store of value, limited supply and security.

Major companies and influential individuals like MicroStrategy, Galaxy Digital Holdings, Square Inc., Twitter's Jack Dorsey, Elon Musk and others either invested large sums into the market, or threw their influence and weight behind Bitcoin's potential.

The big question is: Could we have seen this coming?

Well, we have been watching Bitcoin since 2016/2017, when we saw the boom and bust of epic proportions - and even called the collapse just a couple of months before it happened in December 2017…

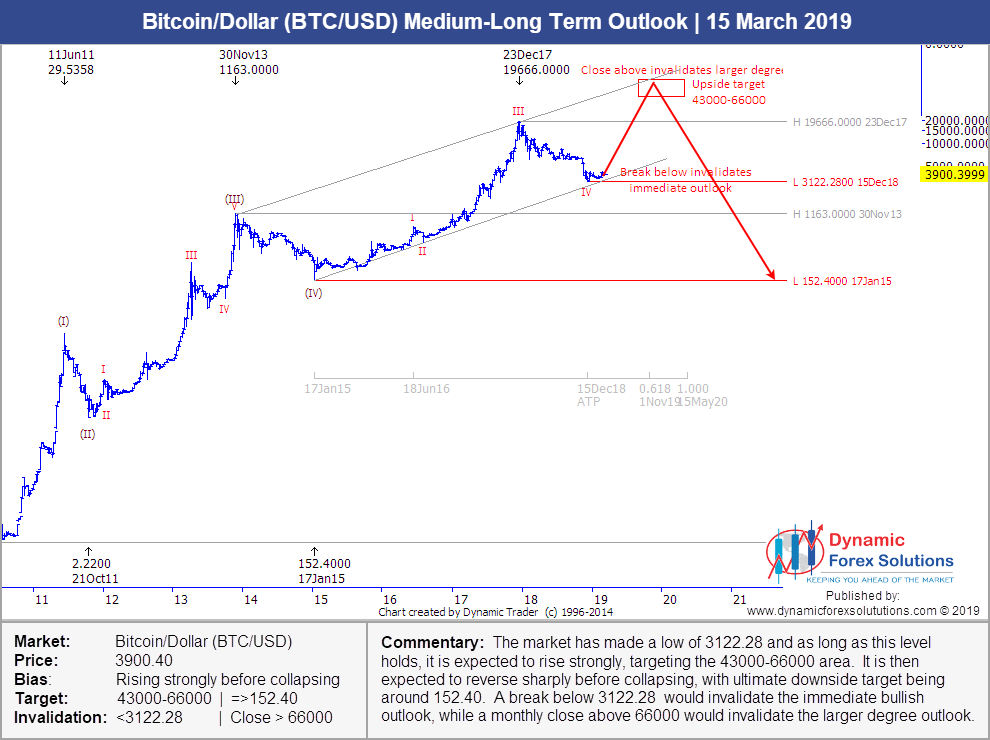

Following that, we have been officially forecasting it since March 2019, when we issued this long term outlook when Bitcoin was sitting at a lowly $3900...

A bold forecast indeed, with a predicted move to over $43000.

How did we do this?

This was a forecast produced using our Elliott Wave based forecasting system, which we have used to predict future market movements of financial markets since 2005.

This system tracks mass human psychology, which is the underlying driver of financial markets.

This is something very few understand, so let me explain:

For a start, humans move the markets - not events.

Events may provide the triggers, but humans are the decision-makers and the action-takers - and therefore the direction-givers.

Studies have shown that 90% of our decisions are emotional (we back this up with logic thereafter). And we tend to make the same (and often irrational) decisions in similar circumstances.

Over and over again.

As a result, the movements we see in financial markets are simply a reflection of the mass human sentiment in that market -

Which tend to flow from one extreme of hope, greed and euphoria …

...to the other of fear, panic and despair in varying degrees.

And these patterns repeat themselves in smaller and larger degrees.

If we then study how these patterns tend to move in relation to each other in terms of price, time and momentum, we can use this information to forecast with some level of confidence where a market is likely to head in time and price in the future, based on how it has moved in the past.

Our forecast from March 2019 is a perfect example of this, where we predicted a move from $3900 to at least $43000 in the next few years..

And that is just what we saw in early February 2021…

...as Bitcoin catapulted above our minimum target levels.

Just imagine what you could have done with this information back in March 2019!

Taking action back then could have resulted in you making more than 12x your investment!

Based on our analysis, this market will again be one to watch in 2021, with volatility and investment/trading opportunities aplenty, but it is not going to be a one-way street by any means, and many will be left licking their wounds.

It remains to be a high risk, high reward market, and one to watch so closely.

The need for an objective view as well as a risk limiting strategy will be imperative if you wish to play in this extremely volatile market.

For info on what forecasts & projections we can offer you, please take a look over here for our Bitcoin Forecasts!

We would also love to hear your thoughts, questions and ideas for how you would like us to cover BTC in the future, as we see this as one of the most influential and interesting markets to follow & predict in the next 5-10 years.

To your success,

James