Bitcoin (BTCUSD) Forecast Service

What You Get Access To When You Subscribe Today

Forecasts on Bitcoin (BTC/USD)

Gain insight into the likely roadmap on the Bitcoin vs Dollar market, to enable you to make informed investment and business decisions, with our predictions giving a complete overview of the upcoming trends.

- Bitcoin vs US Dollar (BTC/USD) Near Term Forecast Updates

- Bitcoin vs US Dollar (BTC/USD) Medium/Long Term Forecast Updates

Additional Bonuses, Features & Tools

- An EXTRA Near Term Forecast update around the 1st of each month

- FREE Market Price Alerts via Email & SMS for any level and any market

- Live Charts on the above market, and many more!

- Access to our head analyst, James Paynter, for all of your burning questions

Dual Time-Frame Forecasts

You will receive two forecasts, covering a total of 3 timeframes:

- Medium-Long Term Forecast - This gives the big picture overview as to where these the market is likely to head for the next few months and years, giving you the information you need to make long term strategic decisions as to WHAT you need to do to protect yourself and benefit from favourable moves. This will be updated once per month, around the 15th, to give you the view ahead for the coming weeks, months and years.

- Near Term Forecast - This is like a zoomed in picture, providing you with an outlook for the probable market movement for the next few weeks. This gives you the information you need as to WHEN the optimal time is to execute on the above strategic decisions to minimize your risk, and maximize your savings and profits. We will update this forecast every 2 weeks, around the 1st and 15th of each month.

Lock in Monthly for just $25...

...quarterly for just $67 (10% off)

...6 monthly for just $127 (15% off)

...or Annually for just $240 (20% off - more than 2 months free!)

Use The Form Below To Get Signed Up Now

To signup for the annual plan using BitPay, use the button below:

What Can This Information Do For You?

Skeptical on how this could benefit you in your decisions?

Well, let us show you some actual examples from our forecasts since publishing these to our inner circle of beta-testers, and how they would have profited handsomely by using the information to make objective, informed and timely decisions.

The best we can do is show you our analysis in forecasting a market that moved significantly in 2019/2020...

...being Bitcoin

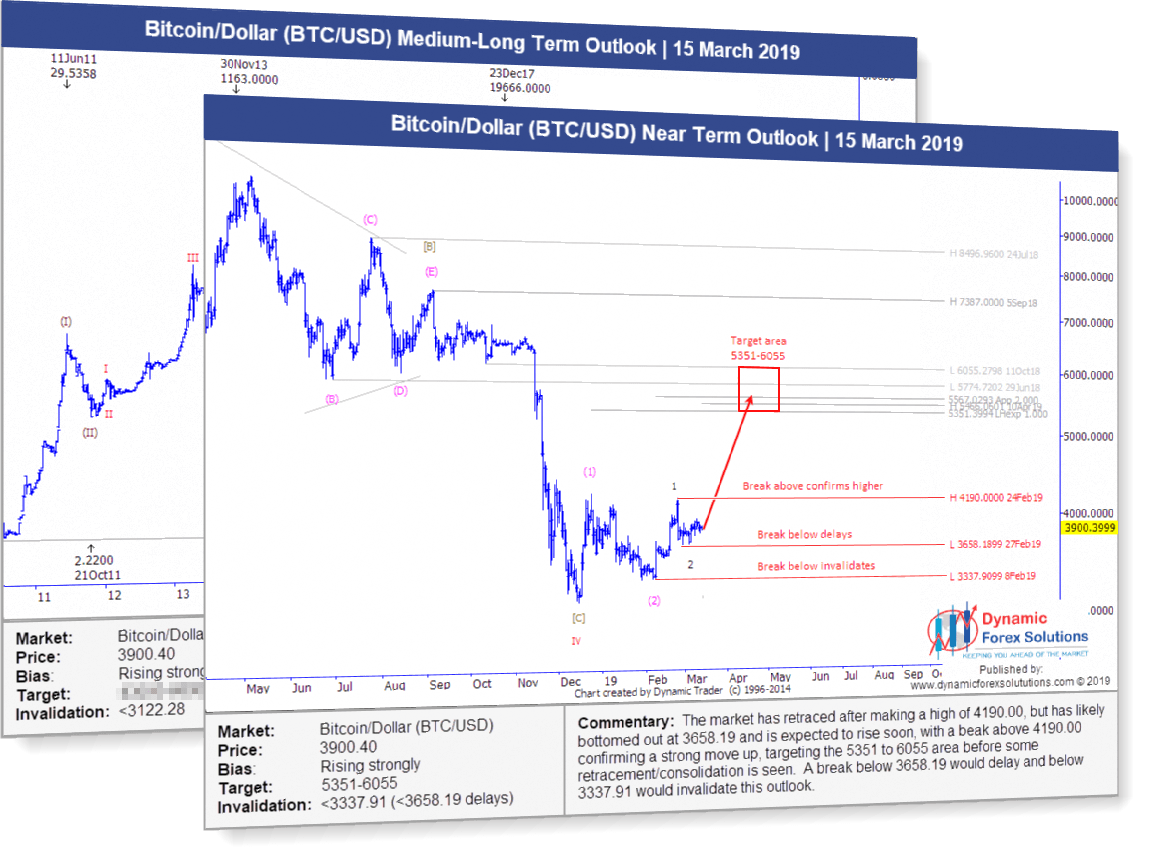

What we predicted for Bitcoin back in March 2019:

By December 2018, Bitcoin had been in a downward trend for over 12 months, and since then it seemed to have been trading in a range.

With our March publication, our analysis showed in both our medium-long term forecast and near term forecast (see charts below) that the market was in the early stages of a multi-month bull run ...

... that was expected to see the market rise strongly over the coming months

... with an initial target of 5551 to 6035 in the coming weeks

As you can see, Bitcoin took off shortly after that to hit the above initial target levels a month later and continued to rise exponentially before hitting $13880 in June.

Just imagine what that could have done for you if you had invested in Bitcoin in March at under $4000?

Conservatively, a tripling of your investment in just 3 months ...

... if you had invested $1000 in March, your investment would have increased to well over $3000 in June!

The Science Behind Our Forecasting System

How does it work?

What is the science and technology behind these forecasts?

All financial markets are moved by mass human sentiment – the millions of persons involved in the market make the decision to buy, sell or do nothing – based on the information available to them and their reaction to this information.

Now, the fact is that, as humans, almost all of our decisions are emotionally-driven – and then back these up with logic afterwards.

As we tend to have the same emotions in similar circumstances, we tend to also make the same (emotionally-driven) decisions in similar circumstances.

As a result, the price patterns that we see on any financial chart are patterns of mass human emotion – which tend to repeat themselves, as the market is driven from extremes of hope and greed, to fear and despair.

This is, in essence, the Elliott Wave Principle, which is the study of human behaviour in financial markets and the laws the govern this irrational yet predictable behaviour.

"What actually registers in the market's fluctuations are not the events themselves, but the human reactions to these events."

- Bernard Baruch, (1870‐1965) – stock market speculator,

statesman, and presidential advisor

Because these patterns repeat themselves in larger and smaller degrees, through analyzing historical patterns using a unique combination of Elliott Wave analysis, price and time wave ratios and momentum and time cycles, we are able to find a best fit for the current market in terms of shape and degree, which then gives us the most likely target for the current market in time and price – based on how the market has reacted historically.

And this is what we have been doing for hundreds of our clients since 2005.

Think of it like a weather forecast for financial markets…

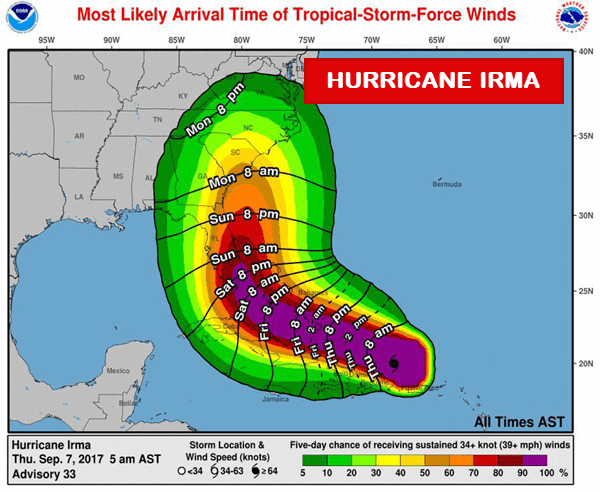

In 2017, the USA and the Caribbean experienced one of the most powerful Atlantic hurricane seasons in history, with Harvey, Irma and Maria all being in the top 5 costliest hurricanes since record-keeping began in 1851.

These massive tropical cyclones caused a combined $215 billion in damage and creating a disaster that affected many, many millions of people.

And yet, many thousands of lives were saved due to one thing –

... a timely warning of what lay ahead.

In the days leading up to landfall, National Hurricane Center provided continual updates, giving the public a forecast of what to expect.

This included such information as anticipated path and speed, expected date and time of landfall, the forecast stormsurge on arrival, and then the expected windspeeds and rainfall.

How did they do this?

Through analyzing historical weather patterns.

And as technology has become better at analyzing these patterns, so the forecasts have become more dependable (Accuweather or Storm is never 100% right, but it is much better at getting it right than I am).

And this is no different, except we are using past patterns of human emotion to forecast future patterns.

And in the same way, giving persons time to make informed decisions – and take action. In time.

What Subscribing Today Will Do For You

What will this information do for you?

Simply, having access to this information will give you the answers you need to the following questions in order to be successful in these markets:

- What is present trend of the market in the longer and shorter timeframes?

- How far this trend is likely to extend within these timeframes?

- When is the market primed for a trend reversal in this timeframe?

- Where is the market likely to head after a trend reversal?

- At what prices level are these assumptions invalidated?

Having these answers gives you the ability to make better decisions as to WHAT to do through having an objective view of the roadmap ahead, but also WHEN to take action...

... enabling you to make rational, informed and well-timed decisions

...instead of emotionally charged knee-jerk decisions, which more than often are made at exactly the wrong time.

Simply put, it provides a roadmap and a framework to make better and informed decisions.

The net result for you:

- Less stress, anxiety and frustration as to what the market is doing

- More clarity and confidence when making your forex decisions

- Make smarter investment decisions, rather than going by gut feel

- More consistency in your finances with a clear outlook into the future

Wouldn't you like that, instead dealing with the stress, anxiety, frustration and anger from making bad decisions?

Well, here is your chance experience it NOW...completely RISK-FREE.

Subscribe at our less-than-a-cup-of-coffee-a-day price...

... and start enjoying having an edge in this market TODAY.

FAQs & Guaranteees

How do I know when there are new forecasts?

We release forecasts once a month, around the 15th. We also offer a free service of sending you a reminder email each and every time forecasts are updated. This means you are kept up to date at all times, and never miss a beat in the markets.

What if I don't find the forecasts of benefit?

In the unlikely event that this doesn't open your eyes to seeing the markets in a new light, then simply cancel your subscription. But please do so only after you have given yourself time to assess it properly. That's why we give you a 60 day money back guarantee - if you are dissatisfied for any reason, we will refund you up to 60 days of your subscription.

How do you accept payment?

You can pay us via a number of different options. We accept most credit cards for online transactions, and then effortless recurring billing to ensure uninterrupted access. We can also however, be paid via PayPal. Please contact us if you would like to use this option.

How do I know my information is safe with you?

All our website content is secured behind SSL Security, with everything being processed over an HTTPS SSL Secured connection. All your card details are stored on a server in America which has even better encryption and security than we have! So you can rest assured that your information is in safe hands

More questions? No problem!

Use the button on the bottom right hand of your screen to contact us either via live chat or email.

We will get back to you ASAP!