Excerpt: Bitcoin's recent surge past $95,000 has set the financial world ablaze, taking many by surprise. But this analysis will help to understand why this monumental shift wasn’t a surprise to us — and how you can harness upcoming opportunities in the cryptocurrency market.

The cryptocurrency realm is buzzing as Bitcoin has just breached the $95,000 mark, reaching an eye-watering peak of 99,800.

While many are left reeling from this astonishing leap, the truth is, we saw this coming...

For over two decades, we’ve cultivated a reputation for being ahead of the curve — making bold and often astonishing predictions across various currency pairs, metals, stocks and more recently, cryptocurrencies.

Our forecasts often defied prevailing market sentiment, standing as beacons of insight when confusion clouded judgment.

Bitcoin, in particular, has exemplified our forecasting success over recent years.

Its notorious volatility might seem unpredictable to the casual observer, but we've consistently deciphered its trends with remarkable accuracy.

By utilizing a distinctive blend of forecasting models — including sentiment cycles analysis, the Elliott Wave Principle, price-relationship ratios, and momentum studies — we're able to offer a projection that not only guides...but has often astounded.

And therefore, the recent rise above $95,000 wasn’t just another tick on the chart to us...

...but a testament to our forecasting model's ability to make audacious (and often very timely) predictions.

Reflecting on Crypto's Dark Winter of 2022

The contrast between 2021 and 2022 couldn't be starker.

In 2021, Bitcoin soared to new heights, reaching an all-time high of $69,000 amid a frenzy of optimism and euphoria...

...yet, by 2022, the mood had shifted dramatically to one of disappointment and fear, the market embroiled in scandals and regulatory investigations that created a toxic atmosphere for traders and investors alike.

As late 2022 approached, Bitcoin had plummeted over 75% to test below $16,000, encapsulating what many termed as crypto’s darkest winter.

Market sentiment was suffocating under waves of despair; headlines screamed of impending doom as analysts predicted Bitcoin would crash below critical support at $13,880.

However, while chaos reigned around us, we spotted an opportunity that others missed.

Leveraging our robust forecasting framework, we identified a different scenario altogether.

Our analysis didn't merely swim against the tide; it boldly contradicted the prevailing pessimism that clouded market outlooks.

A Clear Signal Amidst All The Noise

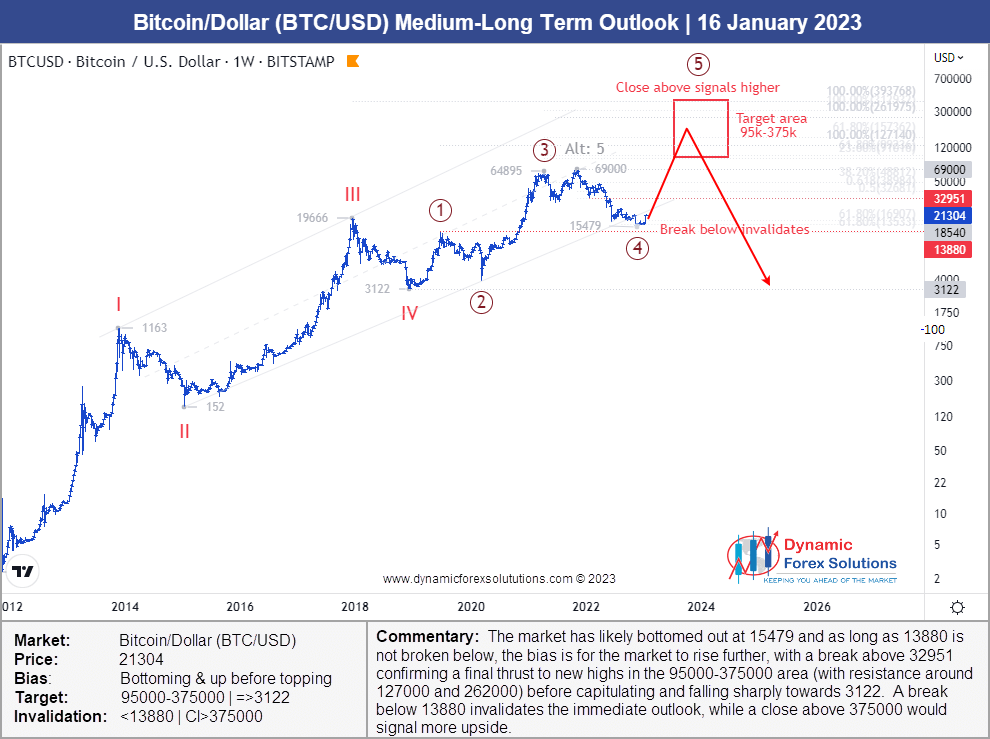

In January 2023, we published the below outlook, predicting that Bitcoin had likely found its bottom at $15,479 —

Not collapsing as many feared, but instead gearing up for a SIGNIFICANT RALLY.

Our medium-term projection hinted at a potential five-fold increase at least, with a minimum target of $95,000 — and potentially as high as $375,000!

This forecast may have sounded audacious at the time; however, we understood one fundamental truth: the market rewards those who can pierce through the noise and see what the sentiment cycles were telling us, instead of being caught up in the hype.

And once again, it rewarded those who dared to embrace this objective perspective rather than succumb to their emotions...

...as the market catipulated higher, testing above $30,000 by April 2023 and by the end of the year was testing the $45,000 level — and continued to push higher to make a new record high by March 2024.

The $50,000 Benchmark: A Crucial Test

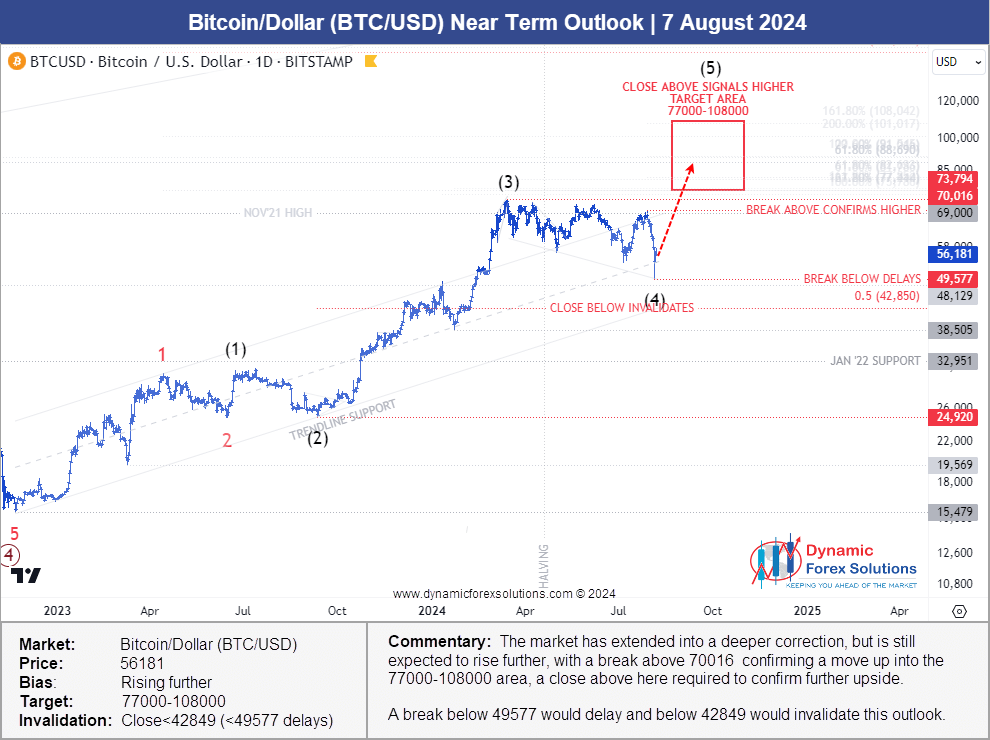

Fast forward to August 2024: Bitcoin had more than quadrupled from its November 2022 lows to reach $$73,794 but had fallen back to test the psychologically significant $50,000 mark.

By then, our early predictions had garnered significant credibility among market participants.

But the question echoed in many minds: “What’s next? Were we still heading higher or had the trend reversed?”

On August 7, 2024, we published our Near-Term Outlook (see below) which revealed that Bitcoin was poised for another major leap over the coming weeks...

...again, contrary to widespread expectations for a reversal, our chart was indicating a bullish target of between 77,000 and 108,000.

And guess what?

That’s exactly what unfolded as Bitcoin surged upwards once more—hitting $95,000 last week and nearly touching the elusive $100,000 mark.

This dramatic turn reinforced our commitment to data-driven forecasting—a model that has consistently pinpointed market tops and bottoms over the years.

The Path Forward: Don’t Let Opportunity Slip By

Now let’s consider your position in all this:

Were you positioned to capitalize on this move back in January—an opportunity ripe for multiplying your investment manifold?

And if so, did you take decisive action? Or were you held back by fear and external influences?

If you found yourself hesitant—that's perfectly understandable.

However, here’s the silver lining: while you might have missed this particular opportunity, numerous chances await on the horizon.

The market is an ever-evolving landscape filled with opportunities just waiting to be seized. Right now, our latest forecasts are signalling incredible setups that could redefine your investment strategy over the coming weeks, months and years.

Whether you’re trading actively or just stepping into this arena for the first time — your success hinges on staying informed...

...instead of falling prey to yesterday's news — or letting your emotions sabotage your decisions.

Instead of reacting too late or letting hesitation stall your progress — here is the opportunity to gain insights that empower you.

Let’s Uncover What Lies Ahead

If you’re eager to discover what’s next for Bitcoin—and other pivotal markets like the Dollar Index, Gold, and Euro—now is your moment to act.

At Dynamic Forex Solutions, we specialize in turning market uncertainty into clear action plans for savvy investors and traders like yourself.

👉 Subscribe today for access to state-of-the-art forecasts that discerning investors rely on—

and enjoy a 7-day free trial, plus 2 free months' access with our annual package!

In closing: Whether you’re refining your investment strategy or exploring fresh avenues in cryptocurrency—embracing informed insights can set you on an upward trajectory in this dynamic market environment.